Credit card debt is probably the most well-known type of debt aside from mortgage and car loan debt. Credit cards are an essential part of the economy. Consumers use them for both personal and business expenditures.

Credit card debt is probably the most well-known type of debt aside from mortgage and car loan debt. Credit cards are an essential part of the economy. Consumers use them for both personal and business expenditures.

Unfortunately, using credit cards irresponsibly is the quickest way to get into trouble with creditors yet devised. The total amount of outstanding credit card debt in the United States was in excess of $2.4 trillion in 2010. Dividing that number by the total number of people in the United States works out to approximately $9,000 for every person.

This large amount is probably smaller now in 2011. Consumers have been paying down the debt they racked up during the last boom from 2003 to 2007. People overwhelmed by their debt loads have been eagerly seeking out methods of paying off creditors. Plenty of debtors have been forced to file for bankruptcy. Others have sought out credit card debt consolidation for help. Consolidating credit card debt by transferring outstanding balances to the card with the lowest interest rate is a well-known method of restructuring the total debt load. It is a way to avoid debt consolidation loans while still responsibly handling debt.

If you’re looking for ways to increase your savings, this article can help. You can implement these tips and strategies starting today, and be on your way to a fat, healthy bank account:

If you’re looking for ways to increase your savings, this article can help. You can implement these tips and strategies starting today, and be on your way to a fat, healthy bank account: Living (and loving) Life

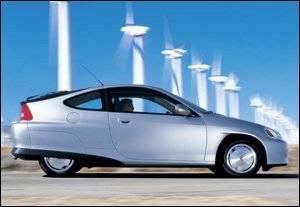

Living (and loving) Life Hybrid cars offer excellent gasoline mileage and a reduction in carbon emissions. When the vehicle is driven less than 45 miles per hour, the electric motor is powering the vehicle. The gasoline engine automatically takes over and higher speeds where the engine is most efficient. This powerful combination of technology and tradition provides an innovative method of transportation for the consumer.

Hybrid cars offer excellent gasoline mileage and a reduction in carbon emissions. When the vehicle is driven less than 45 miles per hour, the electric motor is powering the vehicle. The gasoline engine automatically takes over and higher speeds where the engine is most efficient. This powerful combination of technology and tradition provides an innovative method of transportation for the consumer.